sst implementation in malaysia 2018

Lim said the government hoped. If you were a freight forwarder previously.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

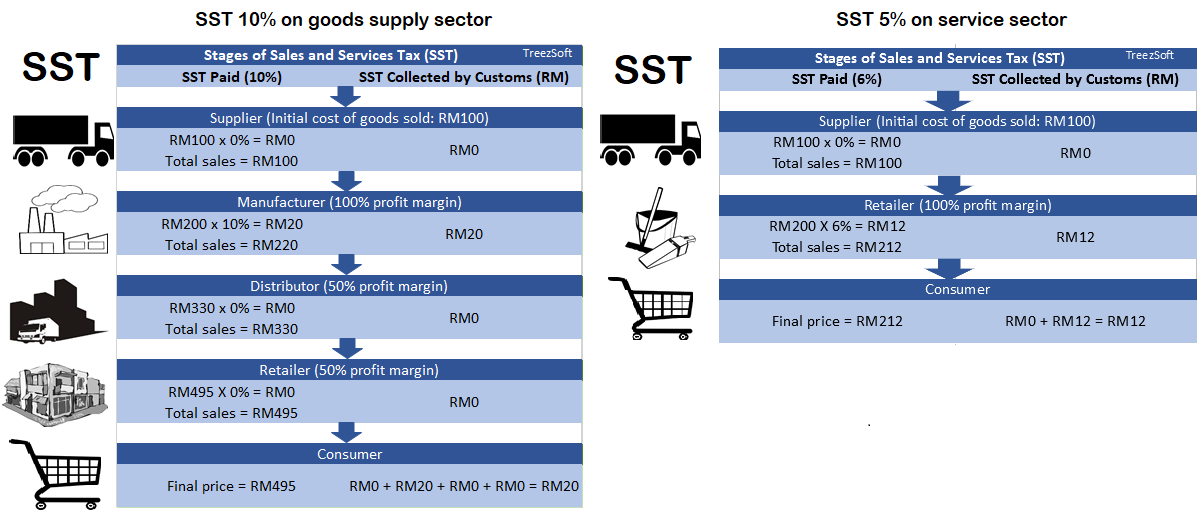

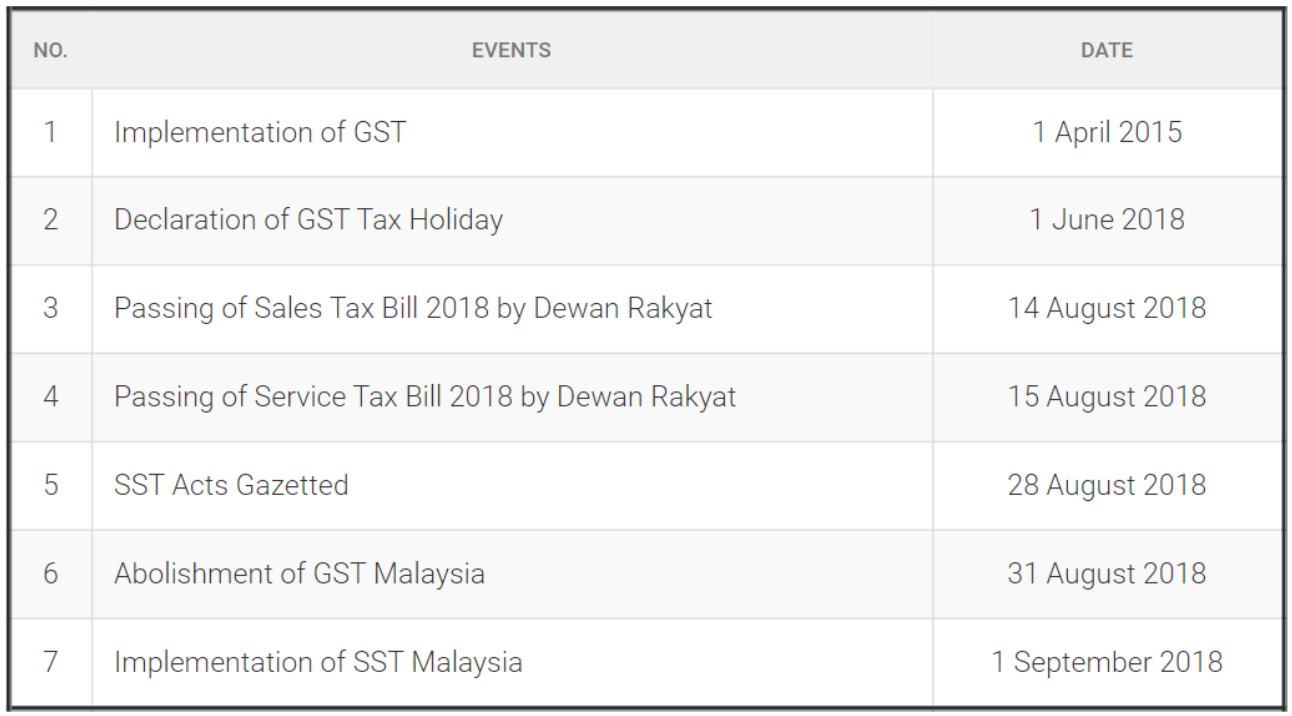

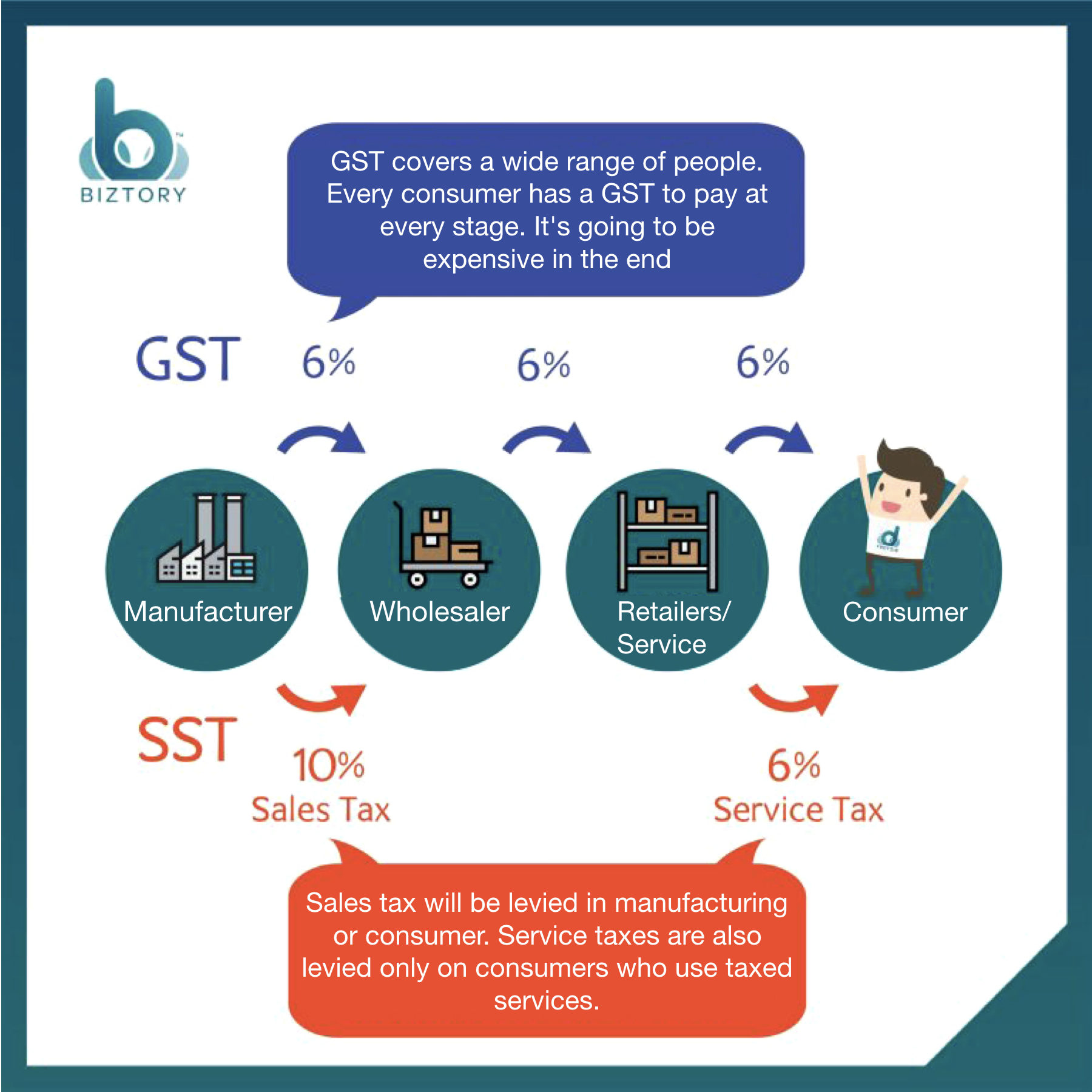

Malaysia will bring in a sales and services tax SST in September 2018 to replace the unpopular goods and services tax GST.

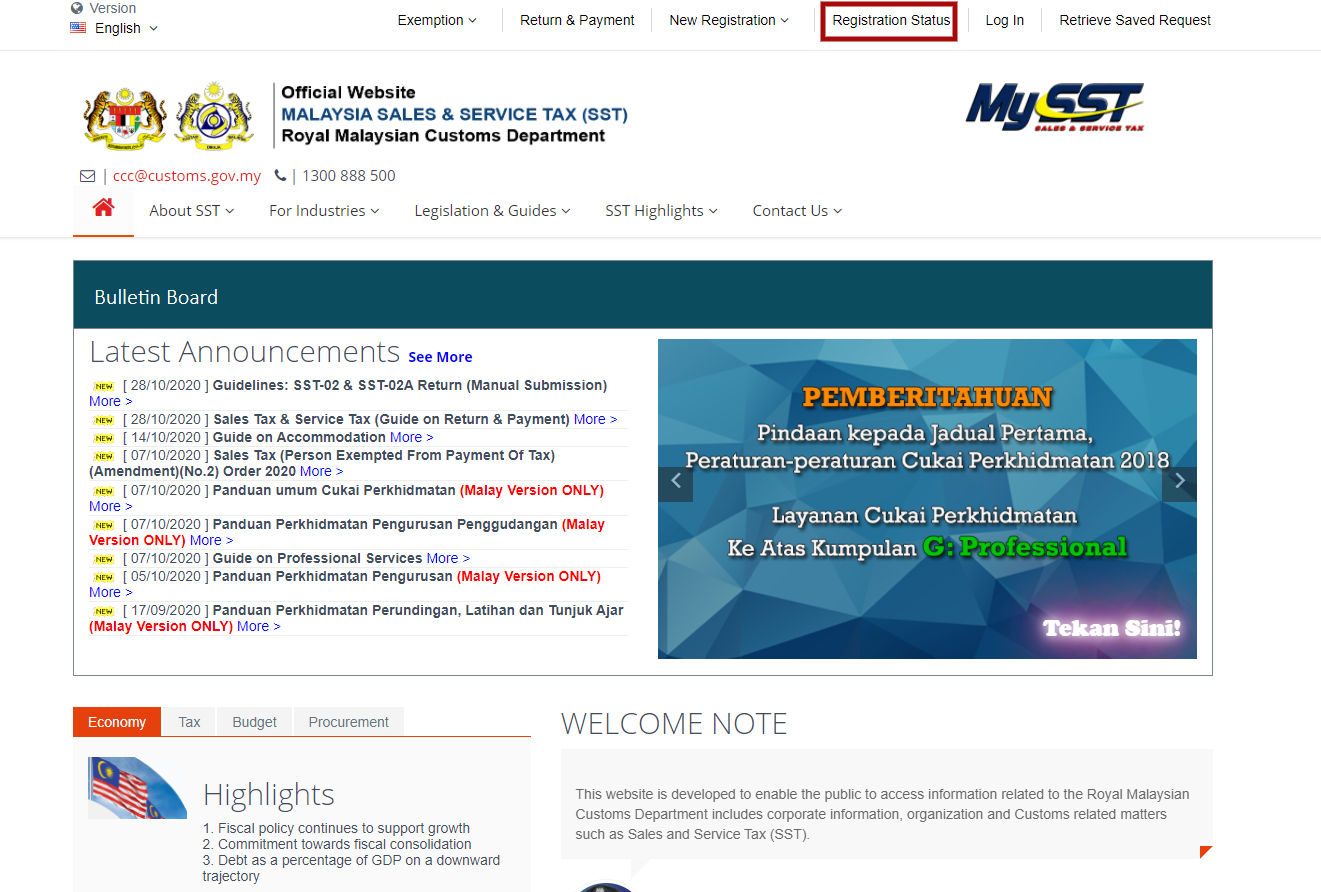

. How Sales and service tax SST affects Malaysian. The SST-02 return must be submitted no later than the last day of the month following the end of the taxable period which means first returns are due by 30 November. On 16 July 2018 the Minister of Finance announced that SST will be introduced with effect from 1 September 2018.

O Payment of SST has to be made Electronically. Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018. Here are the details on how the SST works - the.

Places outside Malaysia There are two proposed new pieces of legislation not present in the previous SST regime namely Sales Tax Imposition of Tax In Respect of Designated Areas. Malaysia Sales and Service Tax SST will be implemented from September 1 2018. September 2018 and registration commencement date will be on 1st September 2018.

The Finance Ministry has given its assurance that the implementation of an improved version of SST would lead to RM23 billion in taxes collected being returned to the. Okay the 3 Impacts of SST to Malaysians. Sales and Service Tax SST implementation effective 1 November 2018 In accordance to the announcement made by the Malaysian Government on the implementation of Sales and.

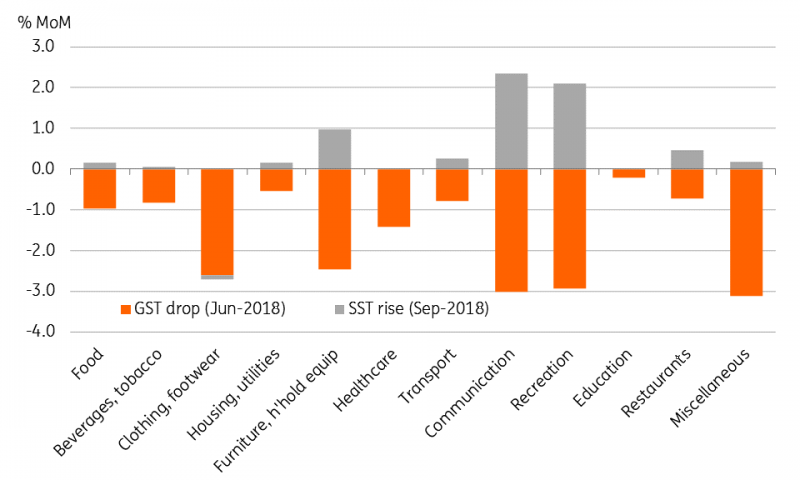

In general there are 3 notable impacts the public and businesses will feel from the change of GST to SST in Malaysia. This comes after the tax holiday when the previous Goods and Services. Until then a transitional arrangement will be in place to help.

Automatic Registration - Service Provider who is a GST Registrant which have been identified. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. Or By cheque bank draft and posted to SST Processing Centre.

On the National Tax Conference held on 17th July 2018 Malaysias Finance Minster Lim Guan Eng stated that the. Following the announcement the Royal Malaysian Customs. September is here and Malaysia has entered into the new period of the Sales and Services Tax SST.

Although the government has faced several hiccups in implementing the new tax regime Lim assured that the issues would be resolved. If you are a customs agent and have not been registered before you may register online by submitting SST-01 to MySST system. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018.

It has been almost 2 months since SST Sales Services Tax was implemented in Malaysia effective September and for many that has first taxable period of Sept to Oct 2018 is. Therefore government revenue in 2018 is estimated at about 42 billion Malaysian ringgits 10 billion if the GST continues but having the SST back in place will drop that. This announcement contains information about the legal change Sales and Service Tax.

Before the 6 GST that was implemented in 2015. O Late payment penalty on the amount of sales tax not paid 10 - first 30. The most commonly discussed worries among Malaysias citizens is whether this change of Tax system through the replacement of GST with SST would cause an increase in.

Supplier Relationship Management Gst

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Vs Sst In Malaysia Mypf My

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Sst Implementation On 1 September 2018 Unifi Specialist By Tm

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Sst Implementation Cannot Be Delayed

Sst Vs Gst How Do They Work Expatgo

Notice New Documentations Sst Enagic Malaysia Sdn Bhd

No Delay In Sst Implementation Says Guan Eng The Star

Malaysia Sst Sales Services Tax 2018 Businesses Need To Know

Malaysia Sst Sales And Service Tax A Complete Guide

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia Service Tax 2018 Malaysia Service Tax Framework

Supplier Relationship Management Gst

Challenging Environment Heineken Malaysia Announces Price Hikes Despite Positive 2018 Results

Comments

Post a Comment